Project Title

Credflow

Platform

Flutter

Tags

Product Deign

Fintech

B2B

About

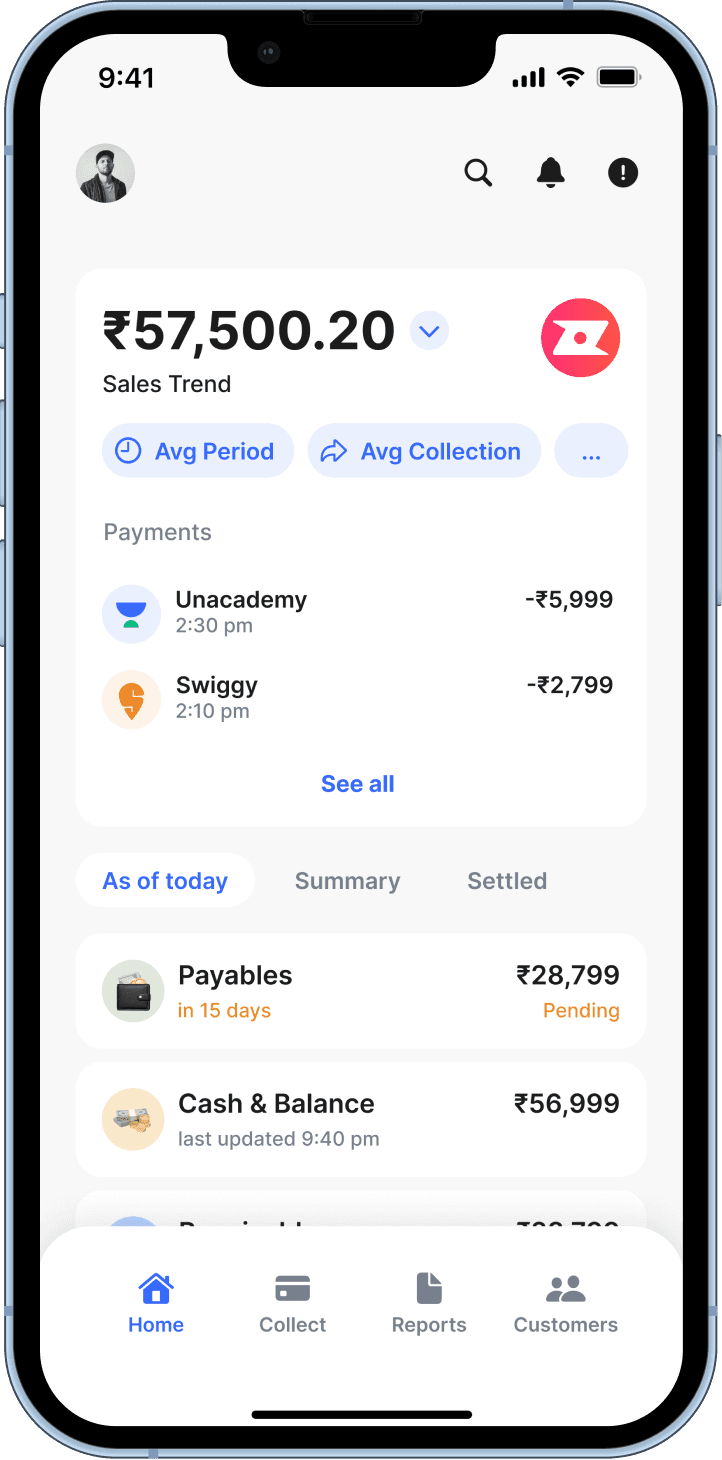

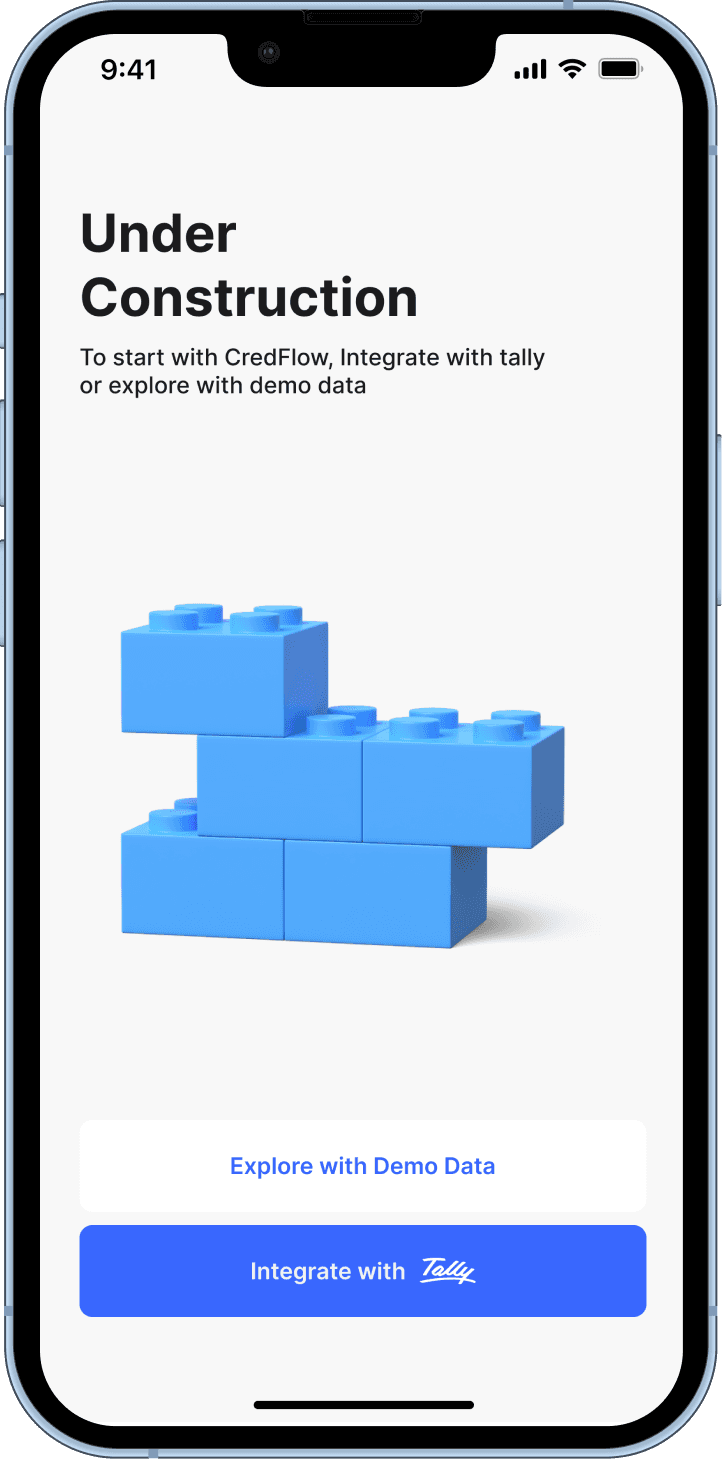

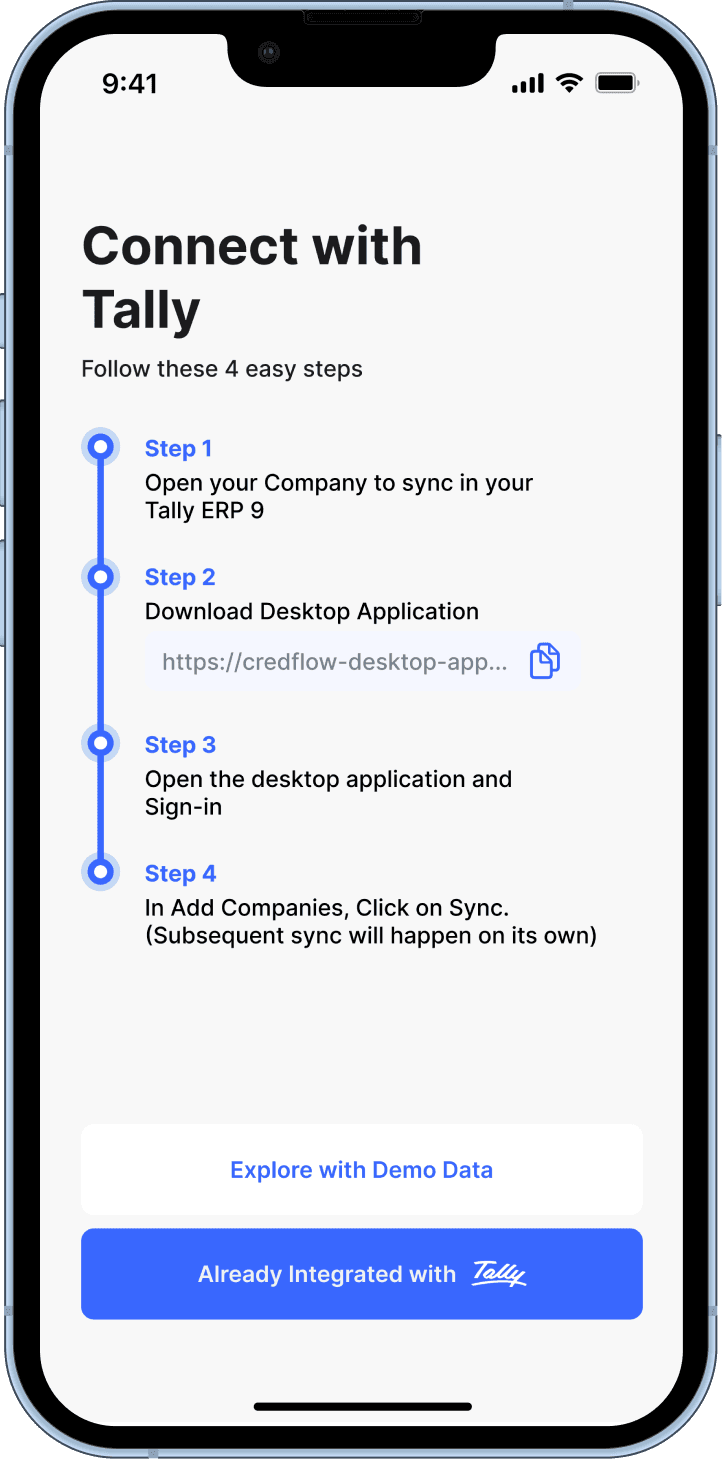

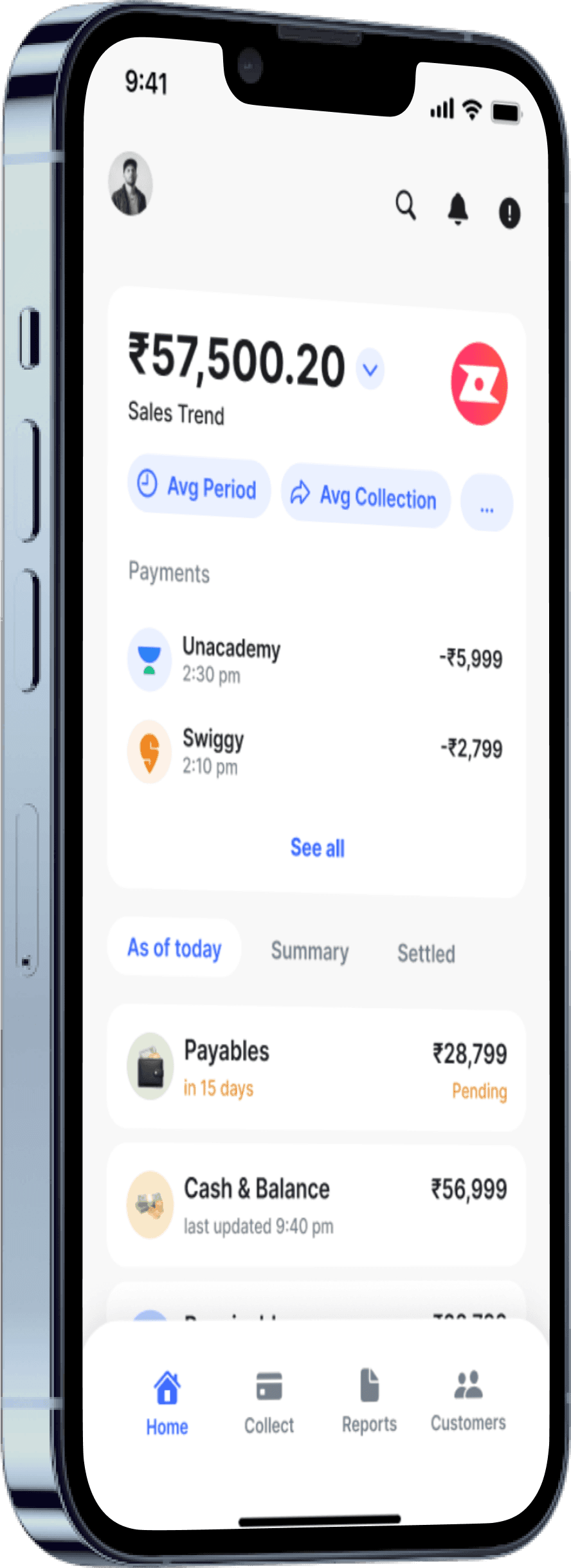

CredFlow is a mobile application that aims to simplify the process of applying for and managing B2B credit. The goal of the project is to create a user-centred design that addresses the pain points of the current B2B credit process via Tally and improves the overall user experience.

Throughout the project, we used a user-centred design approach and iterated on the design based on user feedback to ensure that CredFlow is intuitive, easy to use, and meets the needs of the users.

Ask

Design a Mobile application to manage B2B credit for SMEs

Must have:

🚀 provide a streamlined and intuitive application process to reduce the complexity

🚀 provide real-time updates on the progress

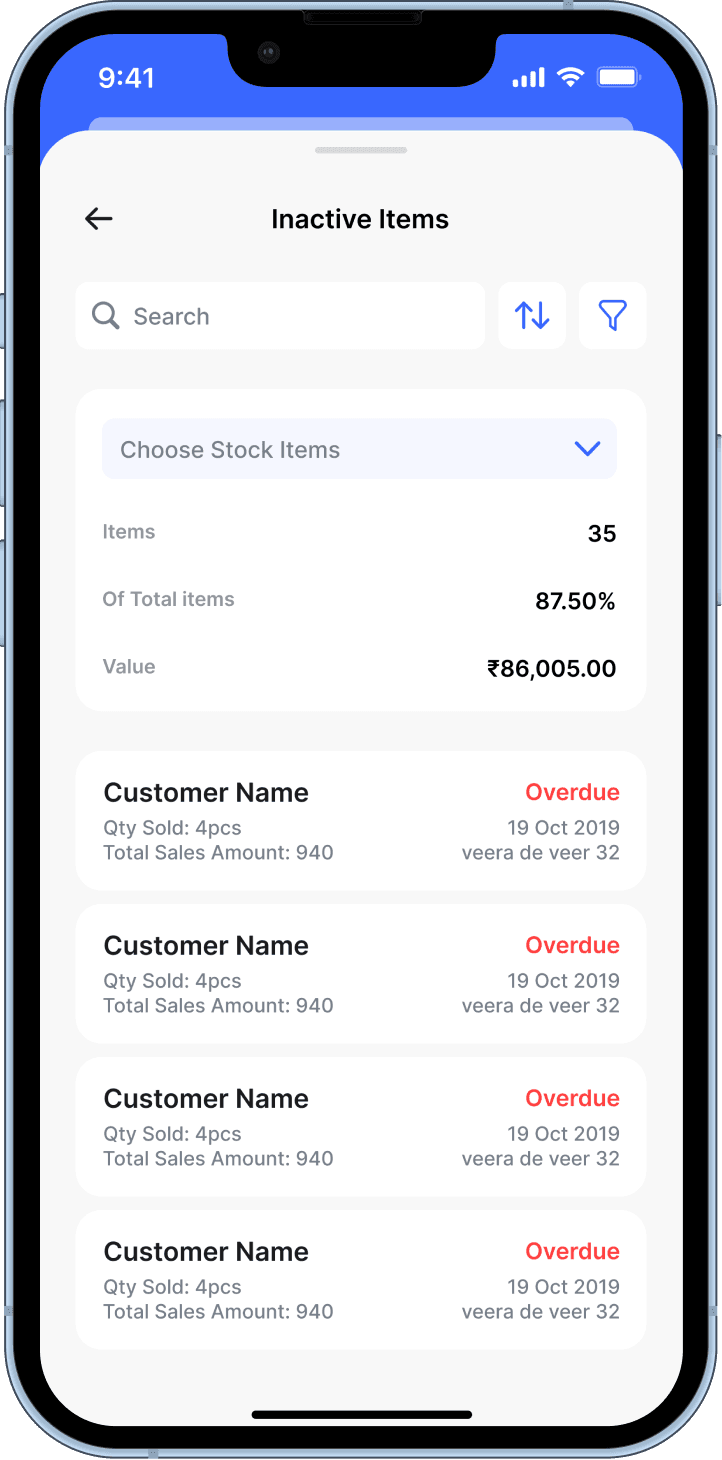

🚀 Should be able to see transaction history

Design Research

About the Research

In order to gather important information and comprehend the desires and requirements of our intended audience, I utilized a combined-method technique, consisting of administering a questionnaire and carrying out a competitive assessment. This all-encompassing research plan enabled us to collect a variety of viewpoints and pinpoint possible challenges and prospects within the payment application sphere.

Ultimately, this thorough investigative method supplied us with significant understanding of our prospective users' inclinations and difficulties when employing tally.

Competitive Analysis

Low Features

Low User Experience

Low Features

High User Experience

High Features

Low User Experience

High Features

High User Experience

User Survey

About the Research

This survey's outcomes reveal that certain individuals experience dissatisfaction while utilizing Tally for B2B credit management, and SMEs find it difficult to navigate. Nonetheless, Tally, being sophisticated software, necessitates training and knowledge in accounting. Employing Tally can be advantageous, yet it presents a significant learning curve for SMEs.

This input can be used to enhance the app and tackle the issues mentioned by users while using Tally.

Findings

Research Findings

After thorough user analysis, including participant questionnaires and comparative evaluations, we identified numerous pivotal aspects to take into account as we proceed with brainstorming and development phases.

Pain Points

SMEs find it harder to use Tally and want a simplified tool

Key Feature Request

Borrow B2B on credit and send reminders to SMEs

Must-have Requirements

Connect with Tally and manage credit for SMEs

Other Issues

Should not require an accountant to manage credit

Wireframes

About the wireframes

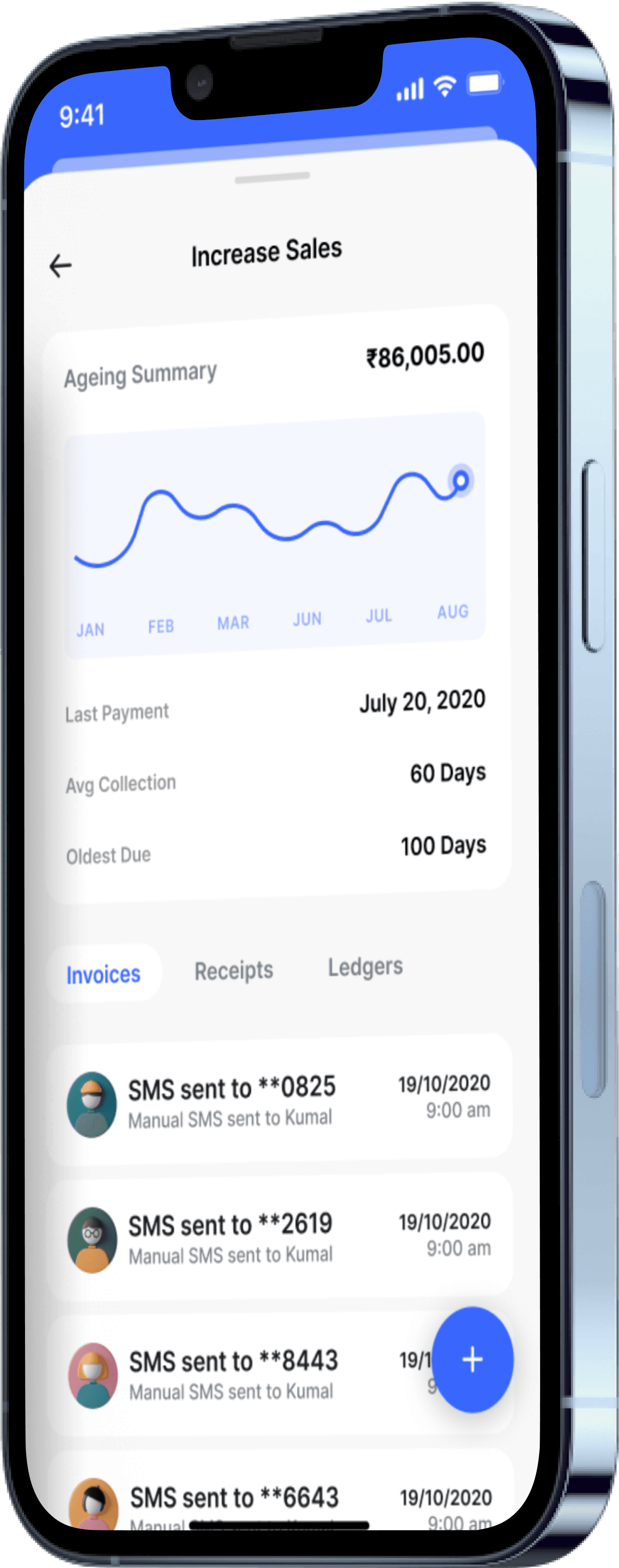

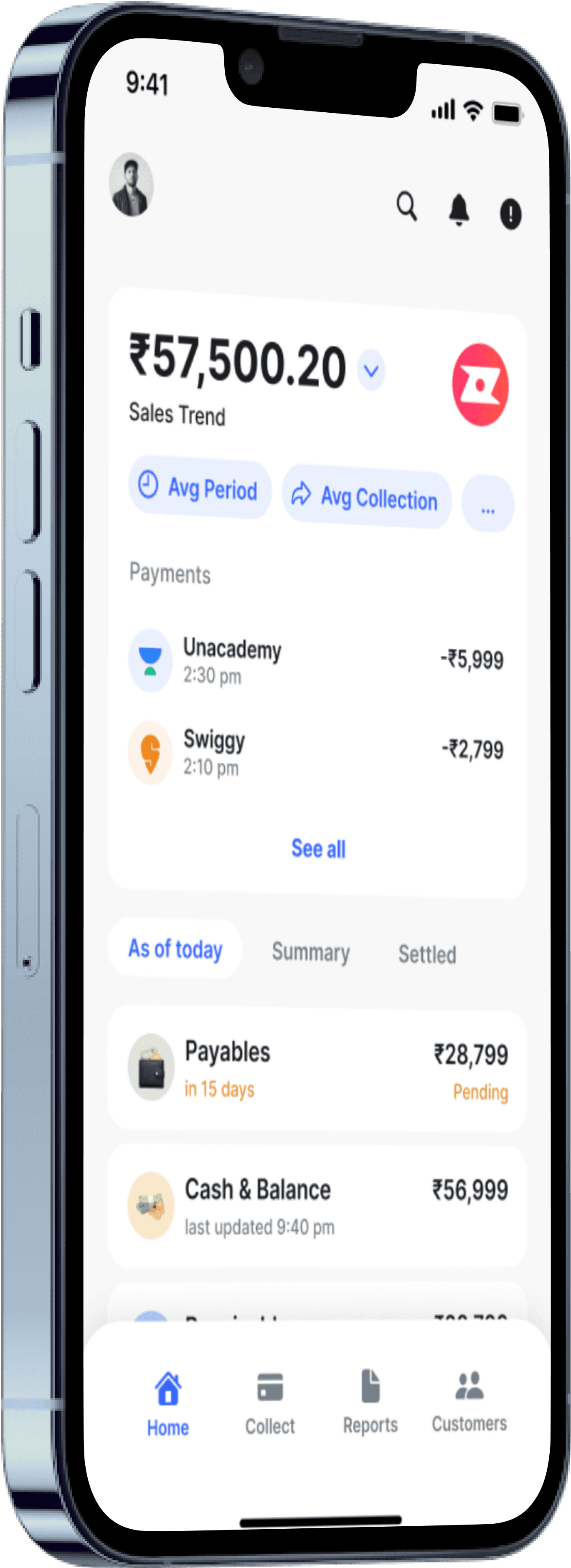

Once comprehending the configuration, I started crafting high-fidelity wireframes for discussion amongst developers, stakeholders, and project leads became a considerably simpler task.

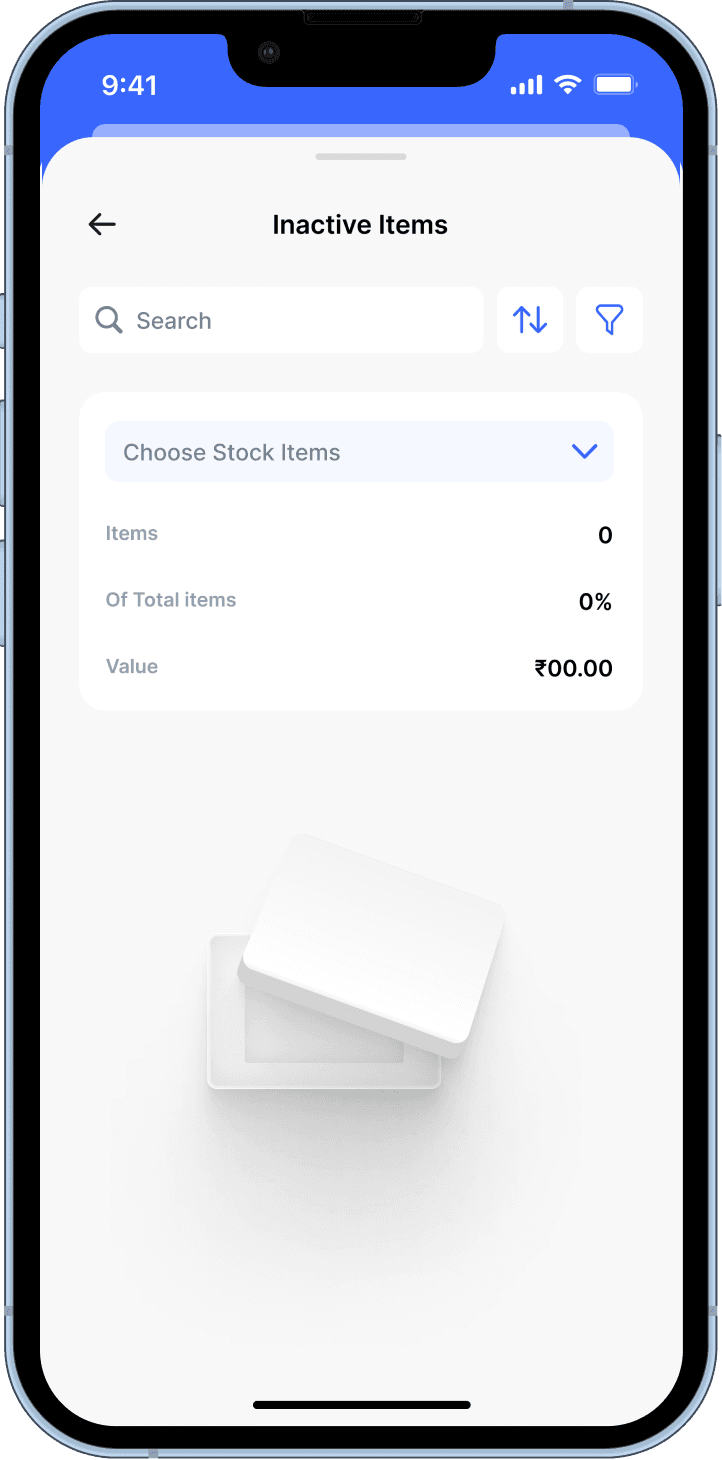

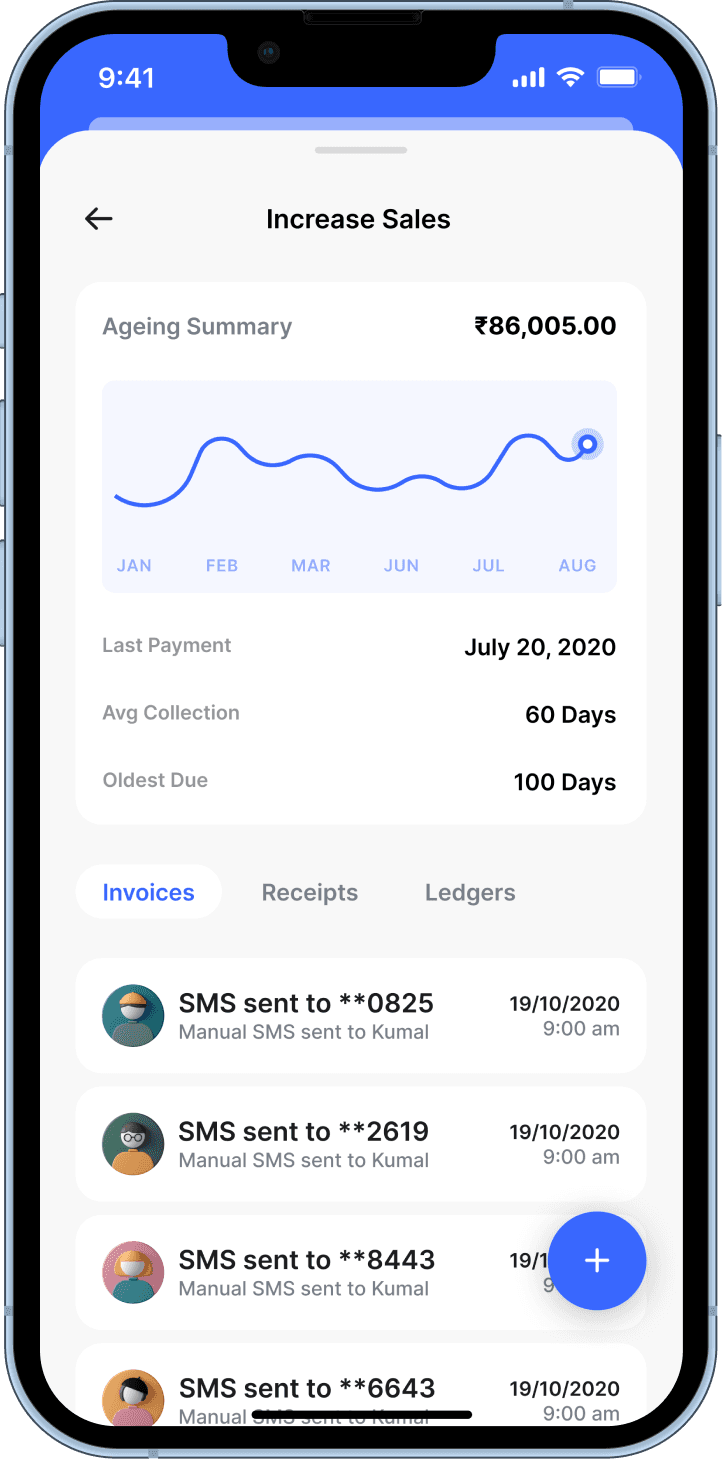

Showcased below are two high-fidelity wireframes for mobile and web applications respectively:

Outcomes

Project Outcomes

This venture provided me with invaluable insights into the B2B landscape and the functioning of credit among SMEs. It presented an engaging challenge that allowed me to address the concerns of small businesses struggling with credit borrowing and Tally usage. The user interface garnered praise from users, and due to a comprehensive competitive analysis, the overall experience mirrored that of other credit borrowing applications, ensuring a smooth onboarding and usage journey.

This project takes pride in the following success indicators:

Conversion Rate

Conversion rates rose by 60%, resulting in preferred user actions.

User Engagement

Small businesses found Tally simpler to utilize, saving 3x their time and resources

Customer Satisfaction

Credflow secured $2.5 million during their seed funding phase